5,9 % decrease in the EU wind turbine market registered between 2010 and 2011

5,9 % decrease in the EU wind turbine market registered between 2010 and 2011

Notwithstanding the economic crisis affecting most of the globe’s major economies, wind energy continues to gain supporters around the world. Global wind power capacity increased by 40.5 GW between 2010 and 2011 compared to a 39 GW rise between 2009 and 2010, after deduction of decommissioned capacity. By the end of 2011 global installed wind turbine capacity should stand at around 238.5 GW, and much of the world’s growth is being driven by capacity build-up in the emerging markets. In contrast some of the key wind energy markets may be showing fault lines.

Category Archives: 2012

Photovoltaic Barometer 2012

51 357,4 MWp in the EU at the end of 2011

51 357,4 MWp in the EU at the end of 2011

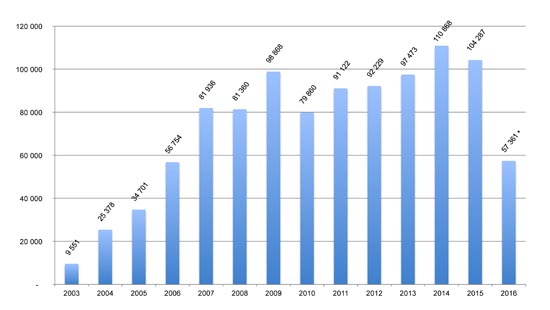

The global photovoltaic market has continued to expand despite the economic and financial crisis. Capacity in excess of 29 000 MWp was connected in 2011, which is roughly 12 200 MWp more than in 2010. The European Union is still the main hive of installation activity. It added more than 21 500 additional MWp of capacity to the grid last year, while outside the EU, the surging Chinese, American and Japanese markets vouch for the enormous growth potential offered by solar power worldwide.

Solar thermal and concentrated solar power barometer 2012

27 545 MWth: the EU’s solar thermal base to date at the end of 2011

27 545 MWth: the EU’s solar thermal base to date at the end of 2011

After two years of sharp decline, the European solar thermal market is bottoming out. The EurObserv’ER survey findings are that the installation figure fell just 1.9% in comparison with 2010, giving a newly-installed collector area of 3.7 million m2. The concentrated solar power sector has been forging ahead alongside the heat production applications, and at the end of 2011 installed capacity passed the one gigawatt mark in Spain for the first time with 1 157.2 MWe.

Biofuels barometer 2012

+ 3,1 % the increase in EU biofuel transport consumption in 2011

+ 3,1 % the increase in EU biofuel transport consumption in 2011

The European Union governments no longer view the rapid increase in biofuel consumption as a priority. Between 2010 and 2011 biofuel consumption increased by 3.1%, which translates into 14 million tonnes of oil equivalent (toe) used in 2011 compared to 13.6 million toe in 2010. The European Union’s attention has shifted to setting up sustainability systems to verify that the biofuel used in the various countries complies with the Renewable Energy Directive’s sustainability criteria.

Biogas Barometer 2012

+ 18,2 % biogas electricity production growth in 2011.

+ 18,2 % biogas electricity production growth in 2011.

Biogas energy recovery for both electricity and heat application has increased in the European Union. The magnitude of the reduction in the primary energy figure can be played down as it can be explained by a change in reporting method of the main producer country, Germany. New markets are starting to emerge in its footsteps, but the economic crisis and regulatory restrictions do not auger well for their expansion.

Renewable municipal waste barometer 2012

+ 2,6 % the growth of primary energy output from renewable municipal waste in the EU relative to 2010.

+ 2,6 % the growth of primary energy output from renewable municipal waste in the EU relative to 2010.

Energy recovery by incinerating household refuse in the European Union led to renewable energy production of more than 8.2 million tonnes of oil equivalent in 2011, which is a 2.6% increase on 2010. While the increase in waste-to-energy recovery is preferable to using landfills, under no circumstances should this growth be made at the cost of waste prevention and recycling policies.

Solid biomass barometer 2012

-2,9 % the growth of primary energy production from solid biomass in the EU between 2010 and 2011.

-2,9 % the growth of primary energy production from solid biomass in the EU between 2010 and 2011.

The winter of 2011 was exceptionally mild, even in Northern Europe, with unusually high temperatures. As a result the demand for firewood and solid biomass fuel was low. The European Union’s primary energy production from solid biomass between 2010 and 2011 contracted by 2.9% slipping to 78.8 Mtoe. Solid biomass electricity production continued to grow, driven by the additional take-up of biomass co-firing.

12th annual overview barometer

This publication provides a complete overview of ten renewable sectors, supplemented by two notes on concentrated solar power and ocean energy. Additionally, for the third year running, the EurObserv’ER consortium members have published their annual renewable energy share estimates of overall final energy consumption for each Member State of the European Union. This issue also provides with the importance of the sectors in terms of employment and turnover. A focus on specific regions that were successful in developing RES sectors shows what are motivating factors for investors on the regional level.

This publication provides a complete overview of ten renewable sectors, supplemented by two notes on concentrated solar power and ocean energy. Additionally, for the third year running, the EurObserv’ER consortium members have published their annual renewable energy share estimates of overall final energy consumption for each Member State of the European Union. This issue also provides with the importance of the sectors in terms of employment and turnover. A focus on specific regions that were successful in developing RES sectors shows what are motivating factors for investors on the regional level.