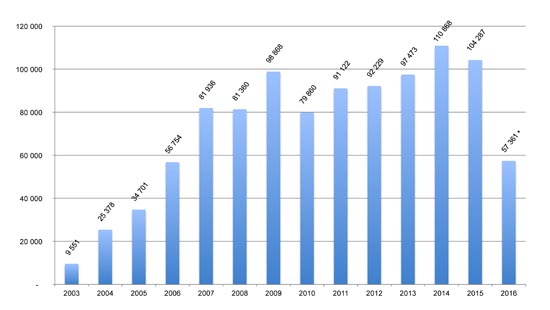

488.1 TWh The estimated electricity production from wind power in the EU of 27 in 2024

One of the European Union’s main weapons for combatting climate change and reducing our reliance on fossil energies is wind energy, which is also a driving force behind competitive electricity pricing for Europe’s economies. The year’s performance was slightly dented by a drop in newly connected capacity. If decommissioned capacity is subtracted from the total, net wind turbine capacity in the European Union to date reached 231.9 GW, having increased by 12.2 GW, including 1.7 GW of offshore capacity. A European regulation was adopted at the end of 2022 that set up a framework for accelerating renewable energy deployment, on the hypothesis that constructing and harnessing renewable energy production facilities are of major public interest. It should make construction permits easier to obtain and relaunch the sector as early as 2025. China’s wind energy market has kept its upward momentum with at least 80 GW of capacity connected in 2024.